TAR Global Review: MLM crypto Ponzi

TAR Global Review: MLM crypto Ponzi

TAR Global fails to provide ownership or executive information on its website.

TAR Global operates from two known website domains:

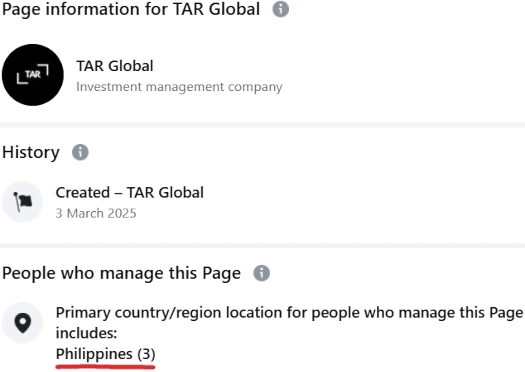

Of note is TAR Global’s official Facebook page being managed from the Philippines:

This suggests that whoever is running TAR Global has ties to the Philippines.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

TAR Global has no retailable products or services.

Promoters are only able to market TAR Global promoter membership itself.

TAR Global affiliates invest USD equivalents in cryptocurrency or cryptocurrency directly (ETH, TON, SOL, BNB and USDT).

This is done on the promise of advertised passive returns:

TAR Global pays referral commissions on invested cryptocurrency down three levels of recruitment (unilevel):

Note that specific commission rates on each referral level are not disclosed.

TAR Global promoter membership is free.

Full participation in the attached income opportunity requires an investment in cryptocurrency.

TAR Global solicits investment in various cryptocurrencies.

In an attempt to appear legitimate, TAR Global trots out a number of external revenue ruses:

No verifiable evidence of TAR Global generating external revenue of any kind is provided.

TAR Global’s offering of a passive returns investment opportunity to consumers constitutes a securities offering. TAR Global fails to provide evidence it has registered with financial regulators in any jurisdiction.

TAR Global dodges this legal requirement in its website FAQ:

Is TAR Global regulated?

TAR Global aims to maintain transparency. Investors should always conduct due diligence before investing.

TAR Global committing securities fraud is significant. In addition to being a legal requirement, filing of audited financial reports is the only way consumers can verify TAR Global is actually generating external revenue.

As it stands the only verifiable source of revenue entering TAR Global is new investment.

Using new investment to pay ROI withdrawals would make TAR Global a Ponzi scheme. Additionally, with nothing marketed or sold to retail customers, the MLM side of TAR Global is a pyramid scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve TAR Global of ROI withdrawal revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they inevitably collapse, the majority of participants lose money. This article references material originally reported by Behindmlm.com

Like

Dislike

Love

Angry

Sad

Funny

Wow

Comments 0