Zater Capital Review: Ron Cartey’s AI trading bot Ponzi

Zater Capital Review: Ron Cartey’s AI trading bot Ponzi

Zater Capital fails to provide ownership or executive information on its website.

Zater Capital’s website domain (“zatercapital.com”), was first registered in 2017. The private registration was last updated on July 26th, 2025.

Note that Zater Capital’s website went live in or around November 2024. The company as represented on Zater Capital’s website didn’t exist before this.

Zater Capital’s official marketing cites Ronald Cartey as CEO:

Cartey, aka Ron Cartey, is a serial fraudster last known to be based out of Pattaya, Thailand.

Cartey, aka Ron Cartey, is a serial fraudster last known to be based out of Pattaya, Thailand.

Cartey, aka Ron Cartey, is a serial fraudster last known to be based out of Pattaya, Thailand.

Cartey, aka Ron Cartey, is a serial fraudster last known to be based out of Pattaya, Thailand.

Fraudulent MLM crypto schemes Cartey is associated with and/or promoted include YoCoin (2016), 3T Networks (2018), Elef World (2022) MayoTrade (2022) and 9xProfits (2023).

Note that list isn’t definitive, it’s only what has been tracked on BehindMLM.

As always, if an MLM company is not openly upfront about who is running or owns it, think long and hard about joining and/or handing over any money.

Zater Capital has no retailable products or services.

Promoters are only able to market Zater Capital promoter membership itself.

Bundled with Zater Capital promoter membership is access to trading signals of unknown origin and various trading support options.

Zater Capital promoters pay a USD equivalent fee to invest cryptocurrency.

This allows Zater Capital promoters to invest cryptocurrency on the promise of daily passive returns:

The MLM side of Zater Capital pays on recruitment of Zater Capital promoters.

There are nine promoter ranks within Zater Capital’s compensation plan.

Along with their respective qualification criteria, they are as follows:

PV stands for “Personal Volume”. In Zater Capital, PV is cryptocurrency invested by personally recruited promoters.

GV stands for “Group Volume”. In Zater Capital, GV is a promoters PV and that of their entire downline.

Zater Capital pays referral commissions via a unilevel compensation structure.

A unilevel compensation structure places an promoter at the top of a unilevel team, with every personally recruited promoter placed directly under them (level 1):

If any level 1 promoters recruit new affiliates, they are placed on level 2 of the original promoter’s unilevel team.

If any level 2 promoters recruit new promoters, they are placed on level 3 and so on and so forth down a theoretical infinite number of levels.

Zater Capital caps payable unilevel team levels at nine.

Referral commission are paid as a percentage of fees paid across these nine levels as follows:

Zater Capital pays a match on daily returns paid to unilevel team promoters.

ROI Match rates are paid down the same nine levels using the same percentages as referral commissions (see above).

Zater Capital rewards promoters for qualifying at Starter rank and higher with the following one-time Rank Achievement Bonuses:

Zater Capital promoter membership is free.

Full participation in the attached income opportunity requires a $99 to $499 annual fee payment and $99 to $21,499 initial investment.

Zater Capital trots out your typical AI trading bot ruse:

In January 2024 the SEC issued an investor alert warning consumers of fraudulent investment schemes utilizing AI marketing ruses.

The Securities and Exchange Commission (SEC) Office of Investor Education and Advocacy, the North American Securities Administrators Association (NASAA), and the Financial Industry Regulatory Authority (FINRA) are jointly issuing this Investor Alert to make investors aware of the increase of investment frauds involving the purported use of artificial intelligence (AI) and other emerging technologies.

Individual investors should know that bad actors are using the growing popularity and complexity of AI to lure victims into scams.

First and foremost, investors should remember that federal, provincial, and state securities laws generally require securities firms, professionals, exchanges, and other investment platforms to be registered.

A promoter’s lack of registration status should be taken as a prompt to do additional investigation before you invest any money.

Zater Capital fails to provide verifiable evidence it generates external revenue of any kind.

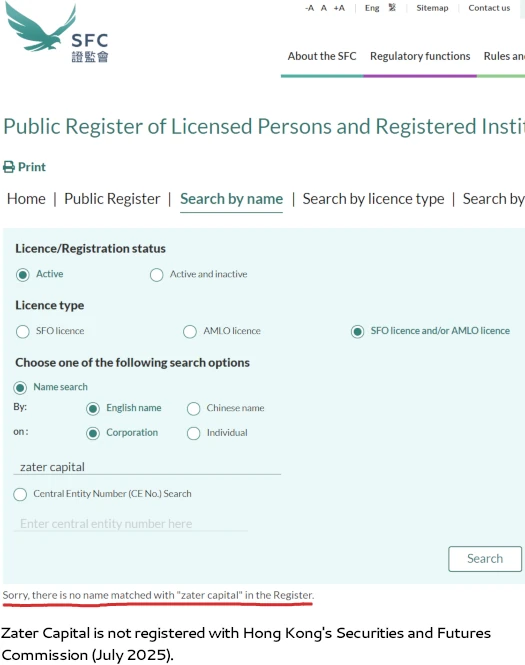

Such verifiable evidence would be audited financial reports filed with regulators. This should be easy to provide, seeing as Zater Capital claims it is registered with Hong Kong’s Securities and Future Commission (SFC):

Yet despite this claim, Zater Capital fails to provide a single audited financial reports.

Why should be obvious, and ties into Zater Capital in fact not being registered with the SFC:

As it stands, the only verifiable source of revenue external revenue entering Zater Capital is new investment.

Using new investment to pay ROI withdrawals would make Zater Capital a Ponzi scheme.

As with all MLM Ponzi schemes, once promoter recruitment dries up so too will new investment.

This will starve Zater Capital of ROI revenue, eventually prompting a collapse.

The math behind Ponzi schemes guarantees that when they collapse, the majority of participants lose money.

For evidence of this in action, look no further than Ron Cartey's previous scam

this article references material original reported by Behindmlm.com

|

|

Like

Dislike

Love

Angry

Sad

Funny

Wow

Comments 0